Sunday, February 6, 2011

Subsidizing the Failure of Education

Tuesday, January 4, 2011

Redistribution Doesn't Reduce Causes of Poverty

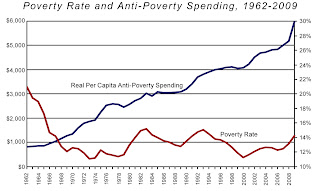

Miron continues: "Between 1966 and 2009, the poverty rate fluctuated with the business cycle but showed little downward trend, even as anti-poverty spending grew by a factor of six in real terms. In other words, our anti-poverty programs have been implemented at enormous and ever-increasing cost — and it is not clear that they have done much to reduce the rate of poverty."

Saturday, December 18, 2010

Politicians Made Healthcare Expensive

Friday, December 17, 2010

Monday, November 8, 2010

The Progressive Obsession with Lording over Us

A popular theme among progressives is that they, in contrast to their mindless Cro-Magnon opposites, overflow with ideas. Progressives see their theories and insights as highly intellectual and enlightened.

But these ideas are almost exclusively about how other people should live their lives. These are ideas about how one group of people (the politically successful) should engineer everyone else’s contracts, social relations, diets, habits, and even moral sentiments.

Put differently, modern progressive ideas are about replacing an unimaginably large multitude of diverse and competing ideas – each one individually chosen, practiced, assessed, and modified in light of what F.A. Hayek called “the particular circumstances of time and place” – with a relatively paltry set of ‘Big Ideas’ that are politically selected, centrally imposed, and enforced not by the natural give, take, and compromise of the everyday interactions of millions of people but, rather, by the simple notion that those with the power of government are anointed to lord over the rest of us.

Wednesday, October 13, 2010

The Electric Tea Party Acid Test

- Tea Party ideology is similar to that of 1960s era hippies.

- The Tea Party movement represents a reverse image of the FDR/Obama camp.

- Hippies were anti-establishment individualists who didn’t like LBJ, the Democrats, or “Great Society” programs.

The Electric Tea Party Acid Test

For my libertarian friends, note the author's claimed difference between anarchists and libertarians in terms of a constructed (learned, indoctrinated, etc) vs. innate (natural, unchanging) belief system. Anarchy requires a belief that people's thinking can be altered. Limited government libertarianism accepts people's thinking as it is.

Also, note how similar the author claims (non-anarchist) libertarians are to Tea Party members and hippies, but how different both are from anarchists.

Friday, September 3, 2010

Analysis of Academic Success and Parenting

The authors of the book Freakonomics analyzed statistical datasets to determine how various parenting methods and other factors are correlated with a child's academic success. They feel most parenting advice is based more on opinion than data. The Freakonomics authors looked at statistical correlation, which, as they note, is not the same as causality. Ketchup is correlated with hamburgers, but ketchup doesn't cause hamburgers.

Factors correlated with academic success:

- Highly educated parents

- High socioeconomic status of parents

- Mother was age 30 or older when first child born

- Child did not have low birth weight

- Parents speak English at home

- Child was not adopted

- Parents involved in PTA

- Many books at home (But it doesn't matter if the books are ever read.)

Factors uncorrelated with academic success:

- Family is intact

- Parents recently moved to a better neighborhood

- Non-working mother

- Attended Head Start

- Parents take child to museums

- Spanking

- Child watches TV a lot

- Parents read to child regularly

The authors note as an overgeneralization that it's more what parents ARE, not what they DO, that is correlated with better academic performance. Smart parents with good jobs who speak English and value education are more likely to raise well-educated children regardless of marital status, neighborhood, whether mom works, how much TV the kids watch, or how much the parents read to kids or take them to museums.

The Freakonomics authors also looked at the effect of charter schools. They determined that children who apply to a charter school perform better academically, whether they get accepted to the school or not, than children who don't apply to a charter school. It's apparently a reflection of the parents' educational values, rather than the specific school, that matters most.

Saturday, May 15, 2010

Growth in Government Spending & Debt Fueled "Recovery"

Tuesday, May 4, 2010

It's The Social Programs, Not Military, That's Bankrupting Us

Five Decades of Federal Spending

The chart below shows federal spending in three component parts over the last five decades.

Sunday, May 2, 2010

Government Burdens on Business

John Stossel read my statement about tax code complexity on his tax special this week on the Fox Business Channel. He had invited me to appear on the TV show, but I didn't want to travel to NYC. My statement is at the very beginning of the clip.

John Stossel Show - Inconvenient Taxes! (Part 3/5)

John Stossel on the Fox Business Channel

Thursday, March 25, 2010

Tea Party Movement Member Demographics

16 percent are Democrats or independent voters leaning Democratic;

5 percent are solidly independent;

45 percent are men;

55 percent are women;

88 percent are white;

77 percent voted for Sen. John McCain in 2008;

15 percent voted for President Barack Obama

Monday, October 26, 2009

Did FDR Save Capitalism?

The economy of the late 1920s had its share of speculation, market bubbles, and other problems, as economies have had since the dawn of civilization. But let's see what the Hoover and FDR governments did about it:

They started a trade war with Smoot-Hawley (Hoover), raised the lowest income tax rate from 0.5% to 4%, raised the highest income tax rate from 25% to 63% (Hoover) then 79% (FDR), raised the corporate tax from 11% to 15%, added a 27% tax on undistributed profits, raised numerous excise taxes, raised the inheritance/estate tax from 20% to 70%, instituted a new 2% employer/employee payroll tax, and much, much more. The effect of the economy was crushing.

The Fed manipulated the money, causing deflation, then later imposed increased reserve requirements on banks leading to lower lending. FDR screwed up markets through his disastrous agricultural policies and subsidies, and his government-imposed industry cartels. FDR also gave unions way too much power and forced up wages, making unemployment worse. Other policies forced up prices, which is the opposite of what's needed in a downturn.

And don't forget the mindlessly idiotic pig slaughter, which has parallels to Cash for Clunkers. Destroy things to artificially create demand. Let's pay half of Americans to dig holes with spoons, and the other half to fill in the holes with spoons. Full employment! Zero productivity! Totally progressive!

All those GOVERNMENT actions are big downers for the economy. Thus the government came in to fix a major problem resulting from their idiotic attempts to fix a much smaller problem. Then we're supposed to believe we needed them. Hah! This is a classic case of a government manufactured crisis.

Sunday, October 11, 2009

The New American Dream

Any able-bodied American can get good quality food, shelter, healthcare, and pocket money, without ever working, all at taxpayer expense.

What a country!

Wednesday, September 23, 2009

The Great Depression and Now

There's a recent WSJ article, Taxes, Depression, and Our Current Troubles, which has some interesting parallels between now and the 1930s. Excerpts and my commentary:

In 1930-31, during the Hoover administration and in the midst of an economic collapse, there was a very slight increase in tax rates on personal income at both the lowest and highest brackets. The corporate tax rate was also slightly increased to 12% from 11%. But beginning in 1932 the lowest personal income tax rate was raised to 4% from less than one-half of 1% while the highest rate was raised to 63% from 25%. (That's not a misprint!) The corporate rate was raised to 13.75% from 12%. All sorts of Federal excise taxes too numerous to list were raised as well. The highest inheritance tax rate was also raised in 1932 to 45% from 20% and the gift tax was reinstituted with the highest rate set at 33.5%.

But FDR did even worse:

But the tax hikes didn't stop there. In 1934, during the Roosevelt administration, the highest estate tax rate was raised to 60% from 45% and raised again to 70% in 1935. The highest gift tax rate was raised to 45% in 1934 from 33.5% in 1933 and raised again to 52.5% in 1935. The highest corporate tax rate was raised to 15% in 1936 with a surtax on undistributed profits up to 27%. In 1936 the highest personal income tax rate was raised yet again to 79% from 63%—a stifling 216% increase in four years. Finally, in 1937 a 1% employer and a 1% employee tax was placed on all wages up to $3,000.

States added to the huge tax increases. The economic effects had to be crushing.

From elsewhere, I looked at the 1929 stock market crash. The market dropped from 381 (Sept 3) to 198 (Nov 13). It then recovered to 294 (Apr 17). Thus, what happened in 1929 proper is comparable to what we've just been through. It was only later that Hoover got things really rolling (down to 41 by 1932). That was after he raised taxes, including higher taxes on goods due to Smoot-Hawley. Taxing is economic friction, exactly what you don't want during an economic downturn.

So if Hoover did so wrong, which I believe he did, why do my "progressive" friends think FDR was right to do the same thing?